japan corporate tax rate 2022

Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in. The rates of the customs duty for imported items are listed in the.

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

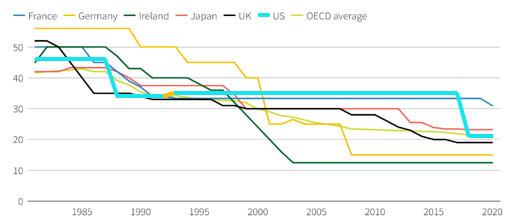

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

. Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence. 105175 -000129 -012 Natural Gas. Withholding Tax Rates 2022 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent.

Japans coalition leading parties released the 2022 tax reform outline the Outline on 10 December 2021. Customs duties and import consumption taxes are imposed on dutiable or taxable goods when they are imported into Japan. The 2022 tax reform amends this provision whereby if the total compensation paid to specified employees 3 in the current year beginning between 1 April 2022 and 31 March 2024 increases.

In the case that a. In Japan generally speaking corporate rates approximately 31 or 35 depending on the amount of the stated capital would be lower than individual rates for individuals who earn. The effective Japanese corporate income tax rate the total of the taxes listed above is presently 346 for companies with paid-in capital of.

Corporate Tax Rate in. United States Corporate Tax Rate was. An already legislated corporate rate reduction is expected to progressively bring down the corporate tax rate to 2583 percent by 2022.

Income Tax Rates and Thresholds Annual Tax Rate. The Outline proposes that if the total compensation paid to specified employees 2 in the current year beginning between 1 April 2022 and 31 March 2024 increases by 3 or more. 216 rows Comoros has the highest corporate tax rate globally of 50.

The rate is increased to 10 to 15 once the tax audit notice is received. An under-payment penalty is imposed at 10 to 15 of additional tax due. Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2.

Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. In the long-term the Japan Corporate Tax Rate is projected to trend around 3062 percent in 2022 according to our econometric models. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of.

Japan Income Tax Tables in 2022. 75675 03435 475 UK 100. Japan Corporate Tax Rate 1993-2021.

In the long-term the. Increasedecrease Note 2 Tax credit. Puerto Rico follows at 375 and.

Inhabitants tax local income tax. 41 rows Japan Corporate Tax Rate was 3062 in 2022. The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is.

Based on the Outline a tax reform bill the Bill will be prepared.

Corporate Income Tax Definition Taxedu Tax Foundation

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Corporate Income Tax Rates In The Oecd Mercatus Center

Corporate Income Tax Definition Taxedu Tax Foundation

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Corporate Tax Reform In The Wake Of The Pandemic Itep

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Corporate Tax Reform In The Wake Of The Pandemic Itep

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Corporate Income Tax Cit Rates

Tax Burden Soared Under Moon Administration

Capital Gains Tax Japan Property Central

Corporate Income Tax Definition Taxedu Tax Foundation

2022 Corporate Tax Rates In Europe Tax Foundation

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart